CCP Online Practice Questions and Answers

What do you call a person authorized to represent another (the principal) in some capacity? He/she can only act within this capacity or "scope of authority" to bind the principal.

A. Engineer

B. Alternate

C. Project Manager

D. Agent

If a project is said to be on a "fast track program/' the fast track method is:

A. Simultaneous working engineering, procurement, and construction, with appropriate overlap from each phase of work so that delays are eliminated and all the work is streamlined into a correct plan of logic/sequence and duration for all of the work

B. First completing engineering and procurement, then executing construction

C. Analyzing the project and specifying the basic approach to be used in its execution; segmenting the project into reasonable number of activities; estimating the time required to perform each activity; placing the activities in time order, considering both sequential and parallel performance

D. Revising the schedule logic to make it possible to identify constraints of faulty logic; revising the durations in the n p schedule that have been based on assumptions regarding the \hay the work would be performed; revise the resources to work multiple shifts; evaluate the use of overtime

What is a basic element of work or a task that must be performed over a given period of time in order to complete a project called?

A. WBS element

B. Activity

C. Resource

D. Commodity

A systematic coding structure for organizing and managing scope, assets, cost, resources, work and schedule activity information is a______________.

A. Cost breakdown structure

B. Code of accounts

C. Cost estimate classification

D. Schedule identification number

Meetings require:

A. Goals, an agenda, preparation, relevant discussions, support for your actions and to consider the total physical and human setting of the meeting

B. Goals, an agenda, preparation, conclusions, control and conversations that are relevant

C. Goals, an agenda, preparation, control, good listening skills and relevant discussions

D. Goals, an agenda, flipchart, computer projector, laser pointer and consulting with others where appropriate

The following question requires your selection of CCC/CCE Scenario 2 (2.3.50.1.2) from the right side of your split screen, using the drop down menu, to reference during your response/choice of responses. 9,375 hours have been expended to date. Planned completion at this time is 75%. The project is determined to be 66% complete. What is the current schedule performance index (SPI)?

A. 0.96

B. 0.88

C. 0.84

D. 1.14

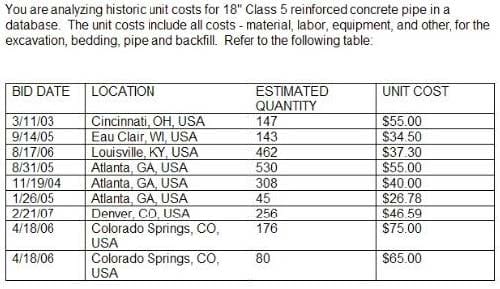

The following question requires your selection of CCC/CCE Scenario 6 (2.7.50.1.3) from the right side of your split screen, using the drop down menu, to reference during your response/choice of responses. What is the range of estimated quantities?

A. $26.78 to $75.00

B. $485

C. $45 to $530

D. $48.22

A major theme park is expanding the existing facility over a five-year period. The design phase will be completed one year after the contract is awarded. Major engineering drawings will be finalized two years after the design contract is awarded and construction will begin three years after the award of the design contract. New, unique ride technology will be used and an estimate will need to be developed to identify these costs that have no historical data.

The latest allowable end time minus the earliest allowable end time on a schedule activity is referred to as:

A. Activity total slack

B. Remaining duration

C. Just-in-time" scheduling

D. Free float

An agricultural corporation that paid 53% in income tax wanted to build a grain elevator designed to last twenty-five (25) years at a cost of $80,000 with no salvage value. Annual income generated would be $22,500 and annual expenditures

were to be $12,000.

Answer the question using a straight line depreciation and a 10% interest rate.

The following question requires your selection of CCC/CCE Scenario 17 (4.2.50.1.1) from the right side of your split screen, using the drop down menu, to reference during your response/choice of responses.

Annual estimated tax would be:

A. $3,869

B. $5,565

C. $10,500

D. $11,925

An agricultural corporation that paid 53% in income tax wanted to build a grain elevator designed to last twenty-five (25) years at a cost of $80,000 with no salvage value. Annual income generated would be $22,500 and annual expenditures were to be $12,000.

Answer the question using a straight line depreciation and a 10% interest rate.

The following question requires your selection of CCC/CCE Scenario 17 (4.2.50.1.1) from the right side of your split screen, using the drop down menu, to reference during your response/choice of responses. Assuming a 53% tax rate, how much cumulative depreciation will have been claimed at the end of the grain elevator's life span?

A. None

B. $42,400

C. $37,600

D. $80,000